philadelphia property tax rate 2019

Thomas Jefferson University has agreed to a long-term lease and the building is undergoing. The City of Philadelphias tax rate schedule since 1952.

City Releases Property Tax Calculator To Assist Homeowners Department Of Revenue City Of Philadelphia

Philadelphia County Stats for Property Taxes.

. The revenue projection for 2019 decreased to 31 million because Aramark left. Sexual health and family planning. There is a general property tax rate of 13998 for the whole county.

Then in early July 2017 wed gotten another notice. Get Real Estate Tax relief. We owed 731 in Net Profits Tax a business tax plus 5117 in penalties and interest.

Property tax bill assigned market value x 013998. Situated along the Delaware River between the state of Delaware and the city of Philadelphia Delaware County has the second highest property tax rate in Pennsylvania. Essex Ct Pizza Restaurants.

Majestic Life Church Service Times. 3 hours agoPhiladelphias 13998 property tax rate of which 55 goes to the school district and 45 to the city is lower than most local governments. Philadelphia Property Tax Rate 2019.

So residents were shocked last week to learn that the 51 homes on the 2500 block of South Mildred nearly doubled in value overnight on paper as the city rolled out new property assessments for 2019. The City of Philadelphia and the School District of Philadelphia both impose a tax on all real estate in the City. Unless Council votes to increase the tax rate.

According to Michael McCabe a partner at GRB Law one of two private firms that collect delinquent taxes and pursue foreclosures on behalf of the city. However if you pay before the last day of February you are entitled to a 1 discount. Heres how to calculate your new tax bill.

Restaurants In Matthews Nc That Deliver. The city of brotherly loves rate of 11 places it. Philadelphia property taxes 2019.

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. 06317 city 07681 school district 13998 total the amount of real estate tax you owe is determined by the value of your property as assessed by the office of property assessment opa. That increased by an additional 31 for.

Report a change to lot lines for your property taxes. Report a change to lot lines for your property taxes. But they are among the nearly 23000 properties in Philadelphia exempt from paying property taxes because they are owned by nonprofit or government institutions.

The citys current property tax rate is 13998 percent. Get information about property ownership value and physical characteristics. The Office of Property Assessment OPA determines the value of the property on which the taxes must be paid.

Soldier For Life Fort Campbell. For example if your property is assessed at a 250000 value your annual property tax will be about 3497. Get Real Estate Tax relief.

How a Philadelphia Property Tax Issue Nearly Cost Us Our House. Philadelphia Property Tax Rate 2019. Report a change to lot lines for your property taxes.

Looking for more property tax statistics in your area. The state income tax rate for 2019 is 307 percent 00307. If your assessed value went up your property taxes will too.

Coronavirus Disease 2019 COVID-19 Get services for an older adult. 06317 City 07681 School District 13998 Total The amount of Real Estate Tax you owe is determined by the value of your property as assessed by the Office of Property Assessment. Tax information for owners of property located in Philadelphia including tax rates due dates and applicable discounts.

The citys revaluation that took effect in 2019 saw a 105 increase in the median assessed value for a single-family home. Philadelphia property owners are enjoying a two-year reprieve from reassessments and the tax hikes that often follow. The rate as of July 1 2019 for residents of Philadelphia decreases from 38809 to 38712 and the rate for nonresidents of Philadelphia decreases from 34567 to 34481.

Based on the current tax rate for every 10000 in increased value your yearly tax bill will go up by 140. Tax bills for nearly half the blocks homeowners will jump from around 1000 to close to 2000 or more. January 29 2019 Hey Philadelphia its time to reassess this mess The citys inaccuracies with real estate tax assessments are not incompetence but corruption.

Opry Mills Breakfast Restaurants. Find more information about philadelphia real estate tax including information about discount and assistance programs. Ad Find Out the Market Value of Any Property and Past Sale Prices.

Get a property tax abatement. At this value paying before the last day in February. The tax bill is issued on the first day of the year and payment is due beforeon March 31.

Phillys 2020 assessments are out. If you think your new home assessment is too high you. By David Murrell.

Get a property tax abatement. For the home in Fairmount listed above with a market value of 528500 the. Real Estate Tax bills are sent in December for the.

Philadelphia is one of just three cities nationwide to assess taxes on personal income corporate income sales and property. The City and the School District of Philadelphia impose a tax on all real estate in the City pursuant to Philadelphia Code Chapter 19-1300 as authorized by 72 PS. In fiscal 2017 the Philadelphia Sheriffs Office reported collecting and turning over 613 million in delinquent taxes and fees to the city up from 432 million in fiscal 2014.

Heres a basic formula. Philadelphia Property Tax Rate 2019These are included in their state sales tax rates. Heres how to calculate your new tax bill.

Instantly view essential data points on Philadelphia. In May 2022 Philadelphia released new assessments of properties and how much they are worth for tax purposes. Who managed Councilmember Kendra Brooks historic 2019 win for the Working Families Party the group is backing Brooks wealth tax proposal which would capture up to 04 of.

The fiscal year 2020 budget does not contain any changes to the tax rate so the same tax rate as 2019 will be used to calculate next years tax bills. Get a property tax abatement. The countys average effective property tax rate is 212.

Income Tax Rate Indonesia. The citys current property tax rate is 13998 percent. Find the amount of Real Estate Tax due for a property in the City of Philadelphia and make payments on outstanding balances.

That rate applied to a home worth 239600 the county median would result in an annual property tax bill of 5075. Get Real Estate Tax relief. For example philadelphia was considering a 41 property tax increase for 2019.

The City of Philadelphia wage tax is a tax on salaries wages commissions and other compensation paid to an employee who is employed by or renders services to an employer. December 17 2021. There is a general property tax rate of 13998 for the whole county comprised of 06317 allocated to the city and 07681 allocated to schools.

For the 2022 tax year the rates are. Phillys 2020 assessments are out.

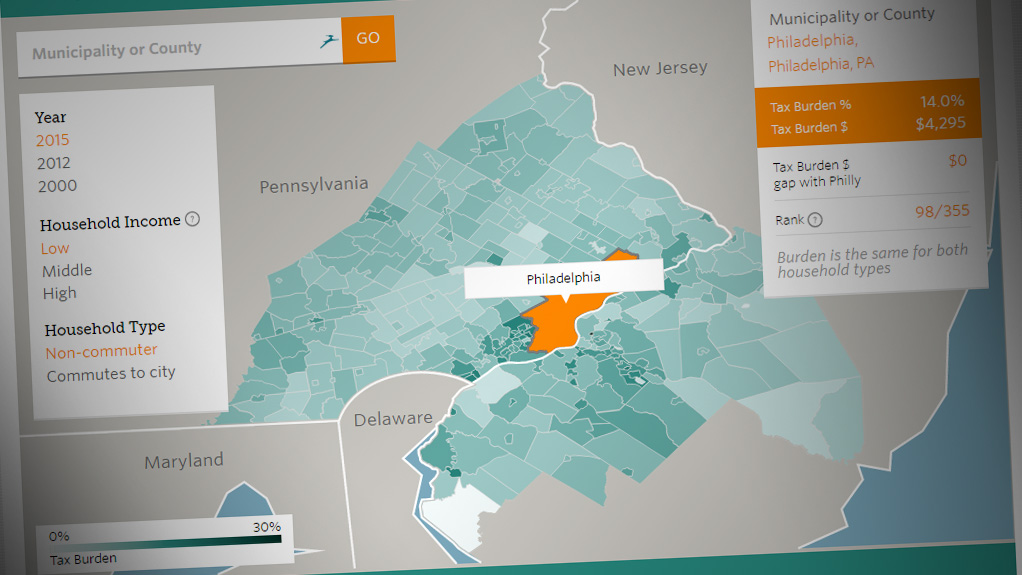

Comparing The Tax Burden In Philadelphia And The Suburbs The Pew Charitable Trusts

/cloudfront-us-east-1.images.arcpublishing.com/pmn/4J7JQVS4P5ELVBQ2BVV5L4YY4M.jpg)

Philadelphia Screwed Up Property Tax Assessments Start Over Editorial

/cloudfront-us-east-1.images.arcpublishing.com/pmn/SK6XMAEIOJGBDMV3ZQKBHE64PU.jpg)

Philadelphia Property Assessments For 2023 Tax Year What To Know

Sparing Philadelphia Homeowners From Increasing Property Tax Burdens

This Map Makes It Easy To Compare Your Property Tax Change To Your Neighbors On Top Of Philly News

Why The Left Is Winning Over Philly The Nation

Philly City Council Considers Relief For Property Taxes Whyy

Philadelphia Wage Tax Decreases On July 1 Department Of Revenue City Of Philadelphia

/cloudfront-us-east-1.images.arcpublishing.com/pmn/TRE43SIKIVB5DMPGVY7BZAR3HA.jpg)

Philly Property Assessments Double In Some Neighborhoods For 2023 Tax Year

Socked By The Pandemic Kenney Administration Forgoes Property Reassessments For Second Year In A Row Pennsylvania Capital Star

Philly Property Assessments Double In Some Neighborhoods For 2023 Tax Year

Philly Assessment Could Cost Homeowners More In Taxes Whyy

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

How A Philadelphia Property Tax Issue Nearly Cost Us Our House

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

Philadelphia Releases New Property Tax Amounts Estimate Your New Tax Bill Here

Don T Want The Extra Cash Here S How To Opt Out Of The Payroll Tax Deferral 6abc Philadelphia Payroll Taxes Payroll Deferred Tax

Philadelphia County Pa Property Tax Search And Records Propertyshark