capital gains tax usa

The income brackets are adjusted. A flat tax of 30 percent is imposed on US.

The High Burden Of State And Federal Capital Gains Taxes Tax Foundation

Everybody else pays either.

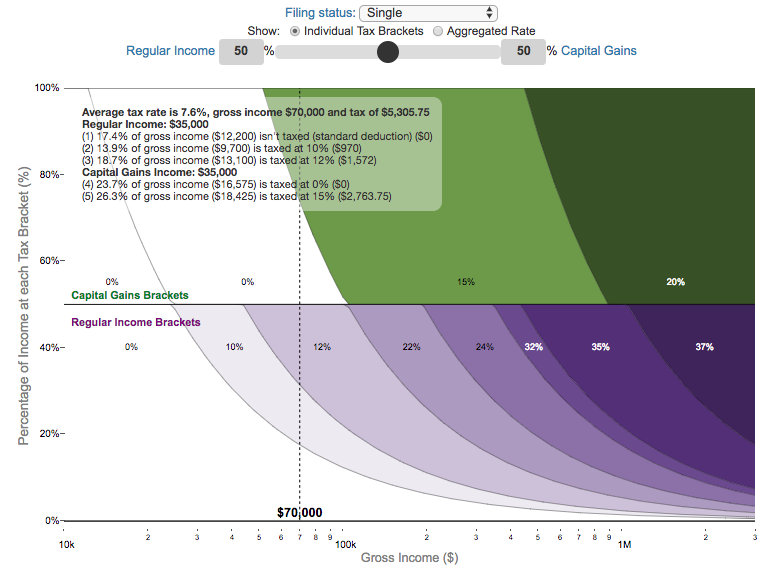

. The current long-term capital gains rate is based on income brackets but is generally anywhere between zero and 20 percent. In the US short-term capital gains are taxed. The long-term capital gains tax rates are 0 percent 15 percent and 20 percent depending on your income.

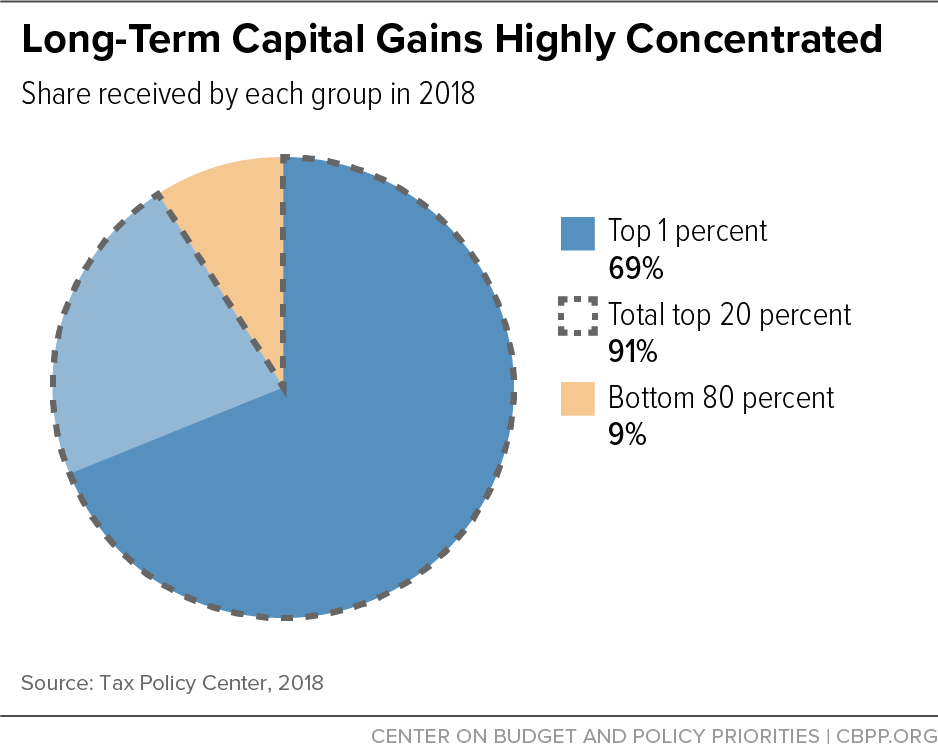

Long-term capital gains tax rates typically apply if you owned the asset for more than a year. The highest-earning people in the United States pay a 238 tax on capital gains. Capital gains and losses are classified as long term if the asset was held for more than one year and short term if held for a year or less.

Even taxpayers in the top income tax bracket pay long-term capital gains rates. As part of this there is a long-term capital gains tax which is a 20 tax on investments held for more than. In the United States the capital gains tax is levied on the profit realized from the sale of a non-inventory asset that was purchased at a lower price.

The long-term capital gains tax rates for the 2021 and 2022 tax years are 0 15 or 20 of the profit depending on the income of the filer. Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0. The capital gains tax rate is.

Short-term capital gains are gains apply to assets or property you held for one year or less. Many people qualify for a 0 tax rate. Capital gains tax rates are the same in 2022 as they were in 2021.

The higher your income the higher your rate. Source capital gains in the hands of nonresident alien individuals physically present in the United States for 183 days or more during the taxable year. The rates are much less onerous.

0 15 or 20 depending on your income. At the state level income taxes on capital gains vary from 0 percent to. The taxable part of a gain from selling section 1202 qualified small business stock is.

If youve held an asset or investment for one year or less before you sell it for a gain thats considered a short-term capital gain. The first capital gains tax was introduced along with the first federal income tax legislation in 1913. Recent tax reform changes are suggesting that long-term capital.

You must report all 1099-B transactions on Schedule D Form 1040 Capital Gains and Losses and you may need to use Form 8949 Sales and Other Dispositions of Capital. Short-term capital gains are taxed as ordinary income. They are subject to ordinary income tax rates meaning theyre taxed federally at either 10 12.

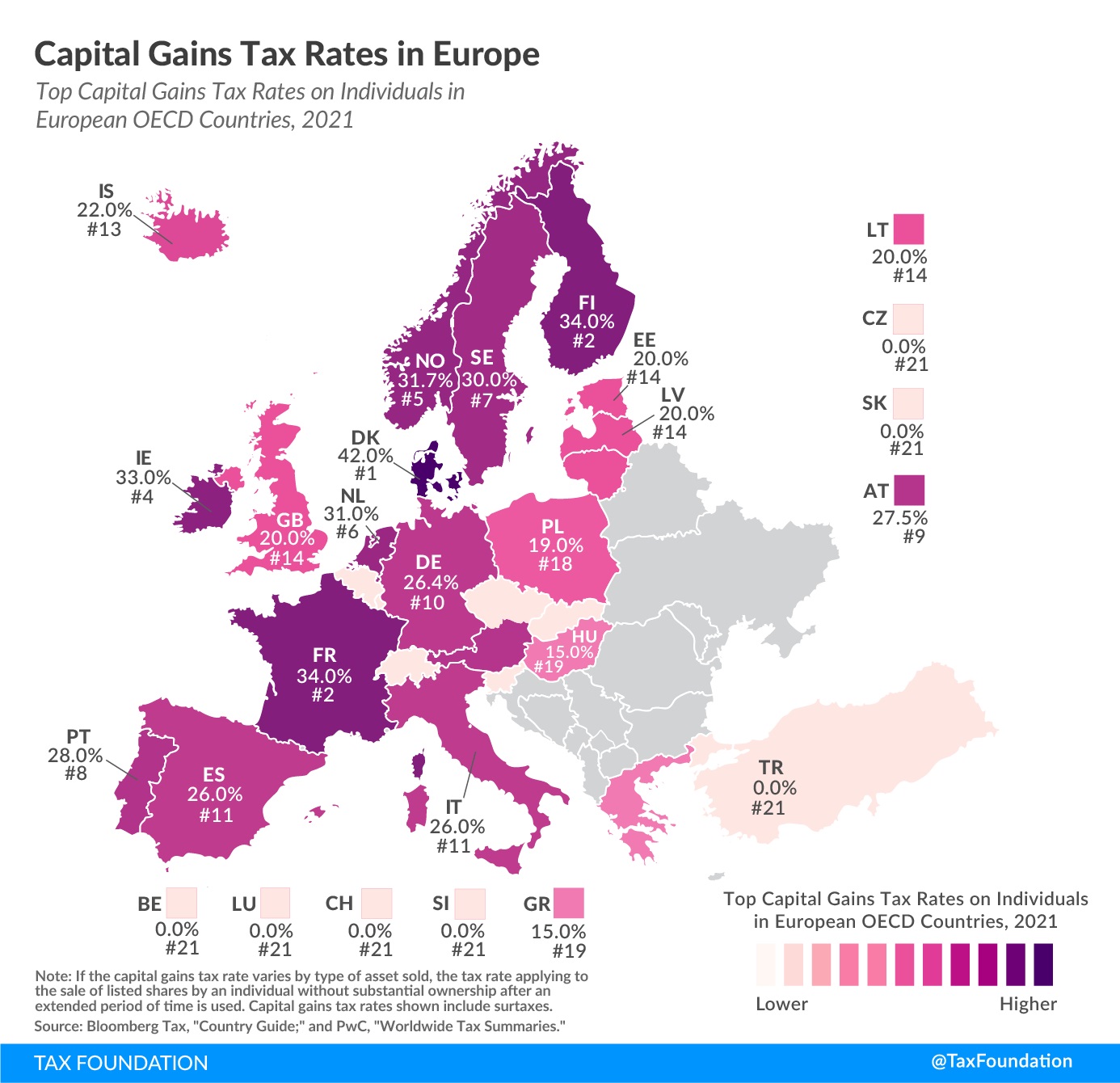

In addition to federal taxes on capital gains most states levy income taxes that apply to capital gains. Capital gains tax rates have fallen in recent years after peaking in the 1970s. These rates are typically much lower than the ordinary income tax.

There are a few other exceptions where capital gains may be taxed at rates greater than 20. Your tax rate is 20 on long-term capital gains if youre a single filer earning more than 445851 married filing jointly earning more than 501601 or head of household earning.

Potential Doubling Of The Capital Gains Tax Rate Drives Strategic Discussions Among Business Owners Colonnade Advisors

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

The High Burden Of State And Federal Capital Gains Tax Rates Tax Foundation

Visual Guide To Understanding Marginal Tax Rates Engaging Data

How The Biden Administration S Green Book Affects Long Term Capital Gains Marcum Llp Accountants And Advisors

Short Term And Long Term Capital Gains Tax Rates By Income

Biden Wants America To Have The World S Highest Tax Burden On Capital Gains International Liberty

Ending Special Tax Treatment For The Very Wealthy Center For American Progress

Bracket Management Lk Benson Company

Capital Gains Vs Ordinary Income The Differences 3 Tax Planning Strategies Kindness Financial Planning

Biden Seeks Tax Hikes On Wealthy To Pay For Ambitious Families Plan

Can Capital Gains Push Me Into A Higher Tax Bracket

Capital Gains Taxes Are Going Up

State Taxes On Capital Gains Center On Budget And Policy Priorities

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

How To Cut Your Tax Bill With Tax Loss Harvesting Charles Schwab

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)